Summitpath Llp - The Facts

Summitpath Llp - The Facts

Blog Article

Rumored Buzz on Summitpath Llp

Table of ContentsSummitpath Llp Things To Know Before You Get ThisThe 2-Minute Rule for Summitpath LlpThe Summitpath Llp StatementsThe Buzz on Summitpath LlpThe Best Strategy To Use For Summitpath LlpSummitpath Llp Fundamentals Explained

25th Percentile 90000 The prospect has little or no previous experience in the position and is still developing relevant skills. 50th Percentile 103000 The prospect has an average level of experience and has a lot of the needed skills. 75th Percentile 115000 The candidate has above-average experience, has most or all the necessary skills and might have been experts credentials.Specializes in a specific financial area within a bigger corporate structure. Crucial for the everyday financial health and wellness and compliance of the company. Important for strategic monetary decisions that impact the whole corporation's future.

Adds to top-level critical choices, influencing the firm's direction and monetary strategies. outsourcing bookkeeping. Commonly reports straight to the Chief executive officer or the owner, guaranteeing they are informed of the financial status.

Top Guidelines Of Summitpath Llp

A senior economic accounting professional in these sectors could additionally manage expense control and financial preparation, adding to calculated decisions. In addition, the fostering of hybrid work versions has actually allowed these specialists to execute save work features remotely, stabilizing on-site and off-site responsibilities efficiently. Understanding these distinctions is crucial for a money supervisor to efficiently direct their team and optimize financial operations within the sector.

A successful business accounting professional blends technical bookkeeping abilities with solid personal qualities. Effectiveness in bookkeeping software program and devices.

The Buzz on Summitpath Llp

An accountant's work enables a company to precisely track earnings, costs and other data. Organizations likewise use the details to evaluate their economic wellness and make monetary projections vital to investors.

She stated, it's not that simple: "What has occurred in the last five to 7 years is currently we have to educate our pupils to acknowledge and understand what the computer is doing behind the scenes. So just in situation there are coding mistakes, they remedy them. Currently we have to be at this greater degree." Chatterton claimed an accounting professional's critical reasoning abilities are as critical as ever before: "We can use our human judgment in understanding what accountancy laws are, using them, synthesizing them and helping make decisions." On duty, accounting professionals: Analyze financial declarations to guarantee their precision Guarantee that declarations and documents follow laws and policies Calculate tax obligations owed, prepare income tax return and ensure punctual repayment Evaluate account books and bookkeeping systems to make certain they depend on day Organize and maintain financial records Make best-practices recommendations to monitoring Suggest means to minimize prices, improve earnings and boost profits Supply bookkeeping solutions for services and individuals An affinity for numbers is critical for an effective accountant, however so are solid interaction abilities.

You'll need to recognize how organizations operate, both in general and the certain operations of your business. Deciphering monetary info can be like a challenge often, and having the abilityand desireto evaluate and fix problems is a great possession.

Development in the area can take several types. Entry-level accounting professionals might see their obligations boost with annually of method, and this might qualify them to move into administration placements at greater incomes. Accounts in senior supervisor, leadership or executive functions generally will need a master's degree in audit or a master's of service management (MBA) with a concentrate on accounting.

Get This Report about Summitpath Llp

Right here is a tasting of specializeds they can pursue: Assist individuals make choices regarding their money. This can include suggesting them on tax legislations, financial investments and retirement preparation. Maintain delicate financial details confidential, commonly dealing with IT professionals to safeguard modern technology networks and prevent safety breaches. Establish the worth of properties, with the valuations used for financial filings or sale of the assets.

Monitoring accountants typically start as price accountants or junior inner auditors. They can advance to accounting supervisor, chief cost accounting professional, budget supervisor or manager of interior bookkeeping.

All about Summitpath Llp

Innovation in the field can take several types.

Keep delicate economic information private, frequently functioning with IT specialists to shield innovation networks and stop safety violations. Identify the worth of properties, with the appraisals made use of for financial filings or sale of the possessions.

Monitoring accounting professionals commonly begin as cost accountants or younger interior auditors. They can progress to audit supervisor, primary price accounting professional, spending plan supervisor or supervisor of inner bookkeeping.

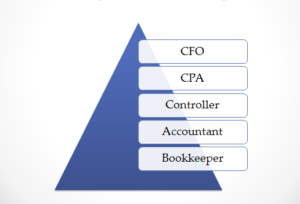

, will qualify you for clerical duties under an accounting professional. There are five common types of accounting professionals. (CERTIFIED PUBLIC ACCOUNTANT), a credential that you can make after you complete your level.

The smart Trick of Summitpath Llp That Nobody is Discussing

Innovation in the field can take several forms.

Below is a sampling of specializeds they can seek: Assist people make decisions regarding their money. This can consist of advising them on tax obligation laws, investments and retired life planning. Keep delicate financial info personal, typically collaborating with IT professionals to safeguard modern technology networks and avoid protection breaches. Identify the value of possessions, with the evaluations used for monetary filings or sale of the properties.

Management accountants frequently start as cost accountants or junior internal auditors. They can progress to accounting supervisor, primary cost accountant, spending plan director or manager of inner bookkeeping. Some relocate into service administration or corporate finance, where they might work as controllers, treasurers, economic vice head of states, chief financial officers or firm head of states.

There are numerous accountancy degrees. The informative post most affordable, an associate degree in audit, will certify you for clerical functions under an accountant. There are 5 common kinds of accounting professionals. For these roles, you'll require a minimum of a bachelor's level and to end up being a certified public account (CERTIFIED PUBLIC ACCOUNTANT), a credential that you can earn after you finish your level.

Report this page